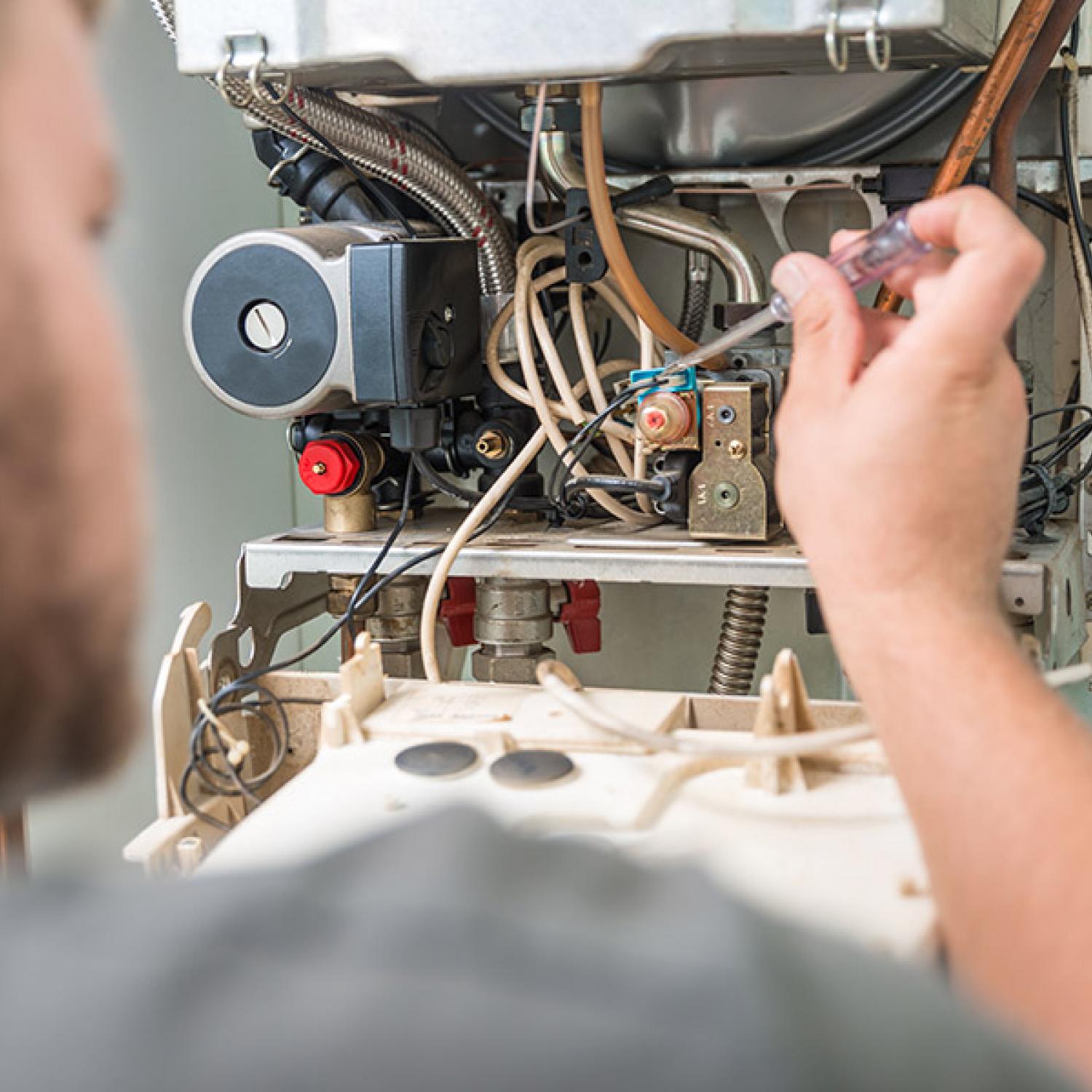

Why do gas and heating engineers need insurance?

Accidents and injury

The work of a gas and heating engineer involves spending time with the public in homes and also in business premises. Your customer might pop in to see if you’d like a drink, trip on your toolbox and fall awkwardly into a worktop, injuring their ribs. You might even accidentally spill jointing compound on a client’s new flooring. These circumstances could result in claims, but with public liability insurance built into gas engineer cover, associated expenses can be accounted for.

Employee troubles

You could have many employees on your payroll, or a single apprentice to help out a few days a week – either way, your staff are your responsibility. The new engineer you’ve taken on could fall from a ladder while working on a commercial project or your administrator might say they’ve developed a painful case of repetitive strain injury (RSI). Should you find yourself facing legal action, we’ll cover the cost of these proceedings and compensation, if you’re ordered to pay it.

Client claims errors

Although you carry out work according to your high standards with every job you take on, a customer could accuse you of not fitting their boiler properly. They might claim it keeps breaking down, say this has resulted in further expense for them and file a claim for negligence. In the event of such circumstances, professional indemnity insurance can provide backing for your standing as a heating engineer – a policy helps to provide cover for compensation costs and legal expenses.

What cover is included in insurance for gas and heating engineers?

Public liability insurance

When working as a gas engineer, public liability insurance can help if someone is injured, or they say their property has been damaged in the context of your work. You come into contact with members of the public on a daily basis and unfortunately small accidents can lead to big claims. Whether the reason for a claim is a mistake resulting in water damage or a customer injury, we’ll help to cover the costs.

Professional indemnity insurance

Gas and heating engineers provide a professional service, meaning there can be opportunity for customers to claim fault with your work. Should you offer poor advice from your position as an expert, make mistakes or breach confidential information which results in financial losses for your customer, professional indemnity insurance can help. The cost of legal expenses and compensation in these instances can mount, but PI cover can protect you for up to £10 million, depending on the limit of indemnity chosen.

Tool insurance

As a heating engineer, tools and equipment are vital to the smooth running of your business, so insurance to cover trade items may be also be important. From spanners to pressure testers, your toolkit is full of integral implements – should these become lost, damaged or stolen, you could find yourself in a tight corner. Investing in this insurance can help you quickly replace or repair your tools to stay on track.

A gas and heating engineer could benefit from a number of insurance products as part of their policy in addition – these include employers’ liability and cyber and data cover. You might also add commercial property, business contents and equipment breakdown insurance.

If you’re not sure what you need, tell us a little more about your gas engineering business. We’ll help you to build your quote and explore any other insurance needs.

Build my coverWhat is a real life example of a professional indemnity claim in the energy industry?

Our customer, the owner of an energy consultancy firm, had a claim brought against his business for alleged ill advice. His client said they had been overcharged by thousands of pounds for their energy use and said this was because of a lack of communication regarding new tariffs.

Hiscox’s deployed experts to assist with the professional indemnity case and defend our customer during the trial during which he was acquitted.

It can be helpful for customers to understand how business insurance works in practice. That’s why we’ve compiled a collection of claims stories to help better understand how legal proceedings can come about.

Does my insurance cover my tools for theft?

Yes, insurance for your tools offers cover for loss, damage and theft, meaning that you can focus your attention on providing the best service possible for your clients. Building equipment cover into your Hiscox heating engineer insurance ensures the cost of replacing stolen items is accounted for should you fall victim to theft.

We understand that, even though locking your tools away securely in your work van is good practice, this doesn’t always guarantee they’ll be safe from theft. Tool insurance can help to provide an extra layer of protection for a gas engineer on top of your standard safety protocols.

Does Hiscox business insurance cover my work on both domestic and commercial properties?

At Hiscox we understand that the work of a gas and heating engineer can involve both domestic customers and commercial clients, so our insurance takes this into account.

For you, no project is more important than another, as you handle gas appliances with the same level of professional care, so your cover needs to keep pace.

Your business might need cover whether you’re working on a large scale commercial contract or installing gas central heating in a private residential home. In order to provide reassurance and protection, our insurance for gas engineers covers a range of scenarios spanning both types of client.

Protecting your tools

The equipment you use as a gas and heating engineer is vital, so insurance might be equally important. Find out more about protecting your tools.

Prepare your business plan on a single page

Launching a business can be daunting, but it doesn’t have to be. Learn how to prepare your business plan on just one page.

What insurance does a sole trader need?If you’ve set up as an independent gas engineer, you might want to investigate your insurance requirements. Discover what cover sole traders need.